Illinois VA Loans

Deciding to purchase a house in Illinois is a huge financial decision, but with the unique benefits provided by the VA loan, your dream of homeownership just got that much easier.

With the average listing price of a home in Illinois landing at $236,049, the VA loan’s signature $0-money-down benefit is a considerable advantage for Illinois homebuyers.

How to get a VA Loan in Illinois

VA loans are made by private lenders and guaranteed by the Department of Veterans Affairs. Because private lenders make the loans and not the VA, you need to find a lender licensed in the state you plan to purchase or refinance.

For example, if you're purchasing a home in Aurora, IL, you'll need to find a lender licensed in Illinois to do the loan.

See also: VA Loan Eligibility Requirements

Other Considerations for Getting a VA Loan in Illinois

VA borrowers in Illinois should also consider the cost and impact of VA loan limits and property taxes when making their home purchase.

Illinois VA Loan Limits

VA borrowers in Illinois with their full VA loan entitlement are not restricted by VA loan limits. This means you can borrow as much as a lender is willing to lend without needing a down payment.

However, Veterans without their full VA loan entitlement are still bound to Illinois’ VA loan limits.

As of January 1, 2025, VA loan limits for all counties in Illinois are $806,500.

Property Taxes in Illinois

Another consideration for VA buyers in Illinois is property taxes. For certain VA buyers, there are exemptions.

You may be eligible for a property tax exemption in Illinois if you meet one of the following conditions:

- If you are a disabled veteran who is 30% to 50% disabled, you can receive a $2,500 reduction in EAV.

- If you a disabled veteran who is 50% to 70%, you can receive a $5,000 reduction in EAV.

- If you are a disabled veteran who is 70% or more, you can pay no property tax.

If you are required to pay property tax in Illinois, the American Community Survey by the U.S. Census Bureau estimates you may pay the following in each county:

| County | Property Tax Rate |

|---|---|

| Adams County | 1.61% |

| Alexander County | 1.22% |

| Bond County | 1.56% |

| Boone County | 1.98% |

| Brown County | 1.51% |

| Bureau County | 1.89% |

| Calhoun County | 1.38% |

| Carroll County | 1.98% |

| Cass County | 1.91% |

| Champaign County | 2.0% |

| Christian County | 1.62% |

| Clark County | 1.58% |

| Clay County | 1.27% |

| Clinton County | 1.74% |

| Coles County | 1.96% |

| Cook County | 1.38% |

| Crawford County | 1.32% |

| Cumberland County | 1.58% |

| De Witt County | 1.55% |

| DeKalb County | 2.22% |

| Douglas County | 1.91% |

| DuPage County | 1.71% |

| Edgar County | 1.51% |

| Edwards County | 1.37% |

| Effingham County | 1.54% |

| Fayette County | 1.48% |

| Ford County | 1.99% |

| Franklin County | 1.30% |

| Fulton County | 1.78% |

| Gallatin County | 0.98% |

| Greene County | 1.49% |

| Grundy County | 1.90% |

| Hamilton County | 1.02% |

| Hancock County | 1.66% |

| Hardin County | 0.71% |

| Henderson County | 1.57% |

| Henry County | 1.90% |

| Iroquois County | 2.00% |

| Jackson County | 1.73% |

| Jasper County | 1.28% |

| Jefferson County | 1.43% |

| Jersey County | 1.45% |

| Jo Daviess County | 1.55% |

| Johnson County | 1.14% |

| Kane County | 2.09% |

| Kankakee County | 1.91% |

| Kendall County | 2.16% |

| Knox County | 1.84% |

| Lake County | 2.19% |

| LaSalle County | 2.10% |

| Lawrence County | 1.29% |

| Lee County | 1.97% |

| Livingston County | 2.24% |

| Logan County | 1.90% |

| Macon County | 2.01% |

| Macoupin County | 1.54% |

| Madison County | 1.75% |

| Marion County | 1.64% |

| Marshall County | 1.95% |

| Mason County | 1.94% |

| Massac County | 1.38% |

| McDonough County | 1.90% |

| McHenry County | 2.09% |

| McLean County | 2.03% |

| Menard County | 1.85% |

| Mercer County | 1.91% |

| Monroe County | 1.64% |

| Montgomery County | 1.69% |

| Morgan County | 1.79% |

| Moultrie County | 1.96% |

| Ogle County | 1.89% |

| Peoria County | 2.00% |

| Perry County | 1.51% |

| Piatt County | 1.67% |

| Pike County | 1.46% |

| Pope County | 1.28% |

| Pulaski County | 1.08% |

| Putnam County | 1.66% |

| Randolph County | 1.38% |

| Richland County | 1.52% |

| Rock Island County | 2.01% |

| Saline County | 1.33% |

| Sangamon County | 1.87% |

| Schuyler County | 1.84% |

| Scott County | 1.49% |

| Shelby County | 1.63% |

| St. Clair County | 1.87% |

| Stark County | 1.81% |

| Stephenson County | 2.28% |

| Tazewell County | 1.85% |

| Union County | 1.30% |

| Vermilion County | 1.72% |

| Wabash County | 1.48% |

| Warren County | 1.74% |

| Washington County | 1.73% |

| Wayne County | 1.16% |

| White County | 1.24% |

| Whiteside County | 2.03% |

| Will County | 2.05% |

| Williamson County | 1.38% |

| Winnebago County | 2.39% |

| Woodford County | 1.90% |

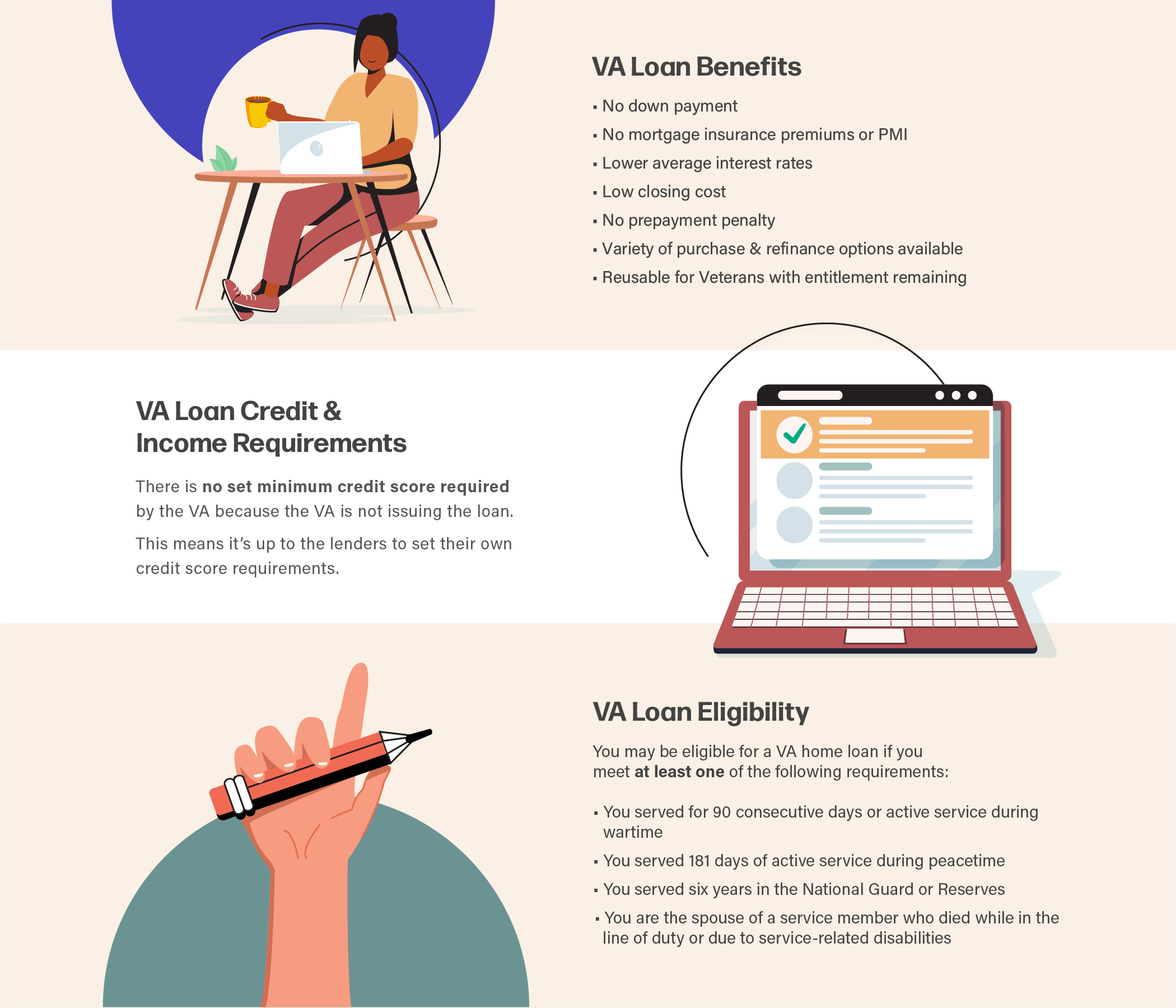

How VA Loans Work in Illinois

View the graphic below to learn more about how VA loans work in Illinois.