Michigan VA Loans

Homeownership in Michigan is a dream for many people, but not everyone has access to a loan program as great as the VA home loan. So whether you are looking to settle down by a lake or in the mountains, you’ll be thrilled with your new home.

With the average listing price of a home in Michigan landing at $340,088 the VA loan’s signature $0-money-down benefit is a considerable advantage for Michigan homebuyers.

See also: VA Loan Options for Other States

How to get a VA Loan in Michigan

VA loans are made by private lenders and guaranteed by the Department of Veterans Affairs. Because private lenders make the loans and not the VA, you need to find a lender licensed in the state you plan to purchase or refinance.

For example, if you're purchasing a home in Grand Rapids, MI, you'll need to find a lender licensed in Michigan to do the loan.

Other Considerations for Getting a VA Loan in Michigan

VA borrowers in Michigan should also consider the cost and impact of VA loan limits and property taxes when making their home purchase.

Michigan VA Loan Limits

VA borrowers in Michigan with their full VA loan entitlement are not restricted by VA loan limits. This means you can borrow as much as a lender is willing to lend without needing a down payment.

However, Veterans without their full VA loan entitlement are still bound to Michigan’s VA loan limits.

As of January 1, 2024, VA loan limits for all counties in Michigan are $766,550.

Property Taxes in Michigan

Another consideration for VA buyers in Michigan is property taxes. For certain VA buyers, there are exemptions

You may be eligible for a property tax exemption in Michigan if you meet one of the following conditions:

- A disabled veteran may receive a full exemption if the veteran is 100 percent disabled as a result of service

- The state offers a homestead tax credit and property tax relief for active military personnel

If you are required to pay property tax in Michigan, the American Community Survey by the U.S. Census Bureau estimates you may pay the following in each county:

| County | Property Tax Rate |

|---|---|

| Alcona County | 1.11% |

| Alger County | 1.13% |

| Allegan County | 1.37% |

| Alpena County | 1.35% |

| Antrim County | 1.07% |

| Arenac County | 1.51% |

| Baraga County | 1.48% |

| Barry County | 1.28% |

| Bay County | 1.83% |

| Benzie County | 0.94% |

| Berrien County | 1.27% |

| Branch County | 1.44% |

| Calhoun County | 1.90% |

| Cass County | 1.13% |

| Charlevoix County | 1.14% |

| Cheboygan County | 1.02% |

| Chippewa County | 1.33% |

| Clare County | 1.33% |

| Clinton County | 1.52% |

| Crawford County | 1.30% |

| Delta County | 1.34% |

| Dickinson County | 1.57% |

| Eaton County | 1.68% |

| Emmet County | 1.13% |

| Genesee County | 1.81% |

| Gladwin County | 1.34% |

| Gogebic County | 1.87% |

| Grand Traverse County | 1.26% |

| Gratiot County | 1.53% |

| Hillsdale County | 1.24% |

| Houghton County | 1.38% |

| Huron County | 1.47% |

| Ingham County | 2.19% |

| Ionia County | 1.35% |

| Iosco County | 1.19% |

| Iron County | 1.56% |

| Isabella County | 1.49% |

| Jackson County | 1.48% |

| Kalamazoo County | 1.73% |

| Kalkaska County | 1.14% |

| Kent County | 1.51% |

| Keweenaw County | 1.17% |

| Lake County | 1.39% |

| Lapeer County | 1.07% |

| Leelanau County | 0.87% |

| Lenawee County | 1.56% |

| Livingston County | 1.17% |

| Luce County | 1.16% |

| Mackinac County | 1.03% |

| Macomb County | 1.68% |

| Manistee County | 1.27% |

| Marquette County | 1.11% |

| Mason County | 1.32% |

| Mecosta County | 1.20% |

| Menominee County | 1.31% |

| Midland County | 1.72% |

| Missaukee County | 1.12% |

| Monroe County | 1.30% |

| Montcalm County | 1.35% |

| Montmorency County | 1.14% |

| Muskegon County | 1.63% |

| Newaygo County | 1.41% |

| Oakland County | 1.55% |

| Oceana County | 1.30% |

| Ogemaw County | 1.22% |

| Ontonagon County | 1.53% |

| Osceola County | 1.34% |

| Oscoda County | 1.08% |

| Otsego County | 1.07% |

| Ottawa County | 1.38% |

| Presque Isle County | 1.19% |

| Roscommon County | 1.22% |

| Saginaw County | 1.77% |

| St. Clair County | 1.37% |

| St. Joseph County | 1.29% |

| Sanilac County | 1.22% |

| Schoolcraft County | 1.12% |

| Shiawassee County | 1.48% |

| Tuscola County | 1.49% |

| Van Buren County | 1.51% |

| Washtenaw County | 1.72% |

| Wayne County | 2.35% |

| Wexford County | 1.39% |

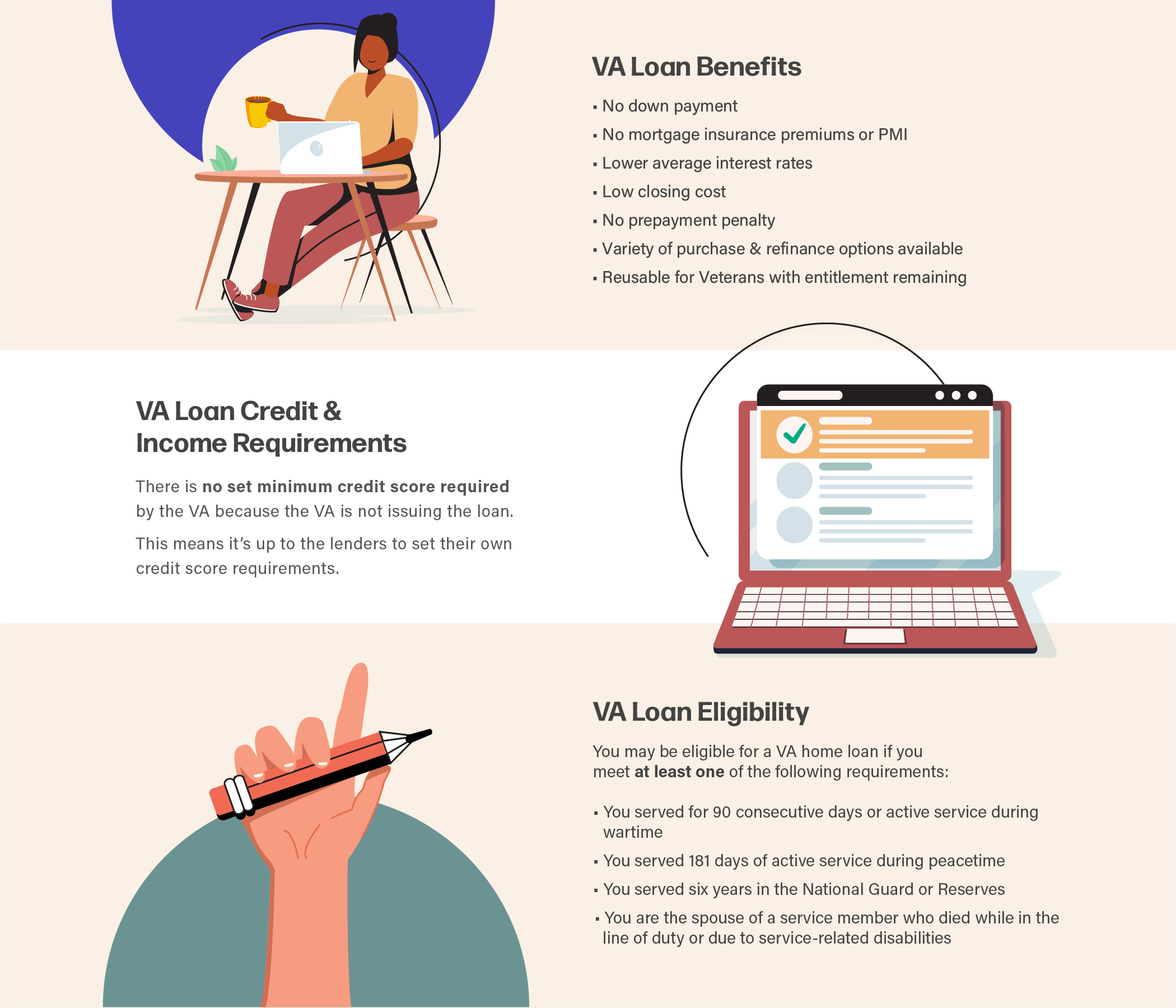

How VA Loans Work in Michigan

View the graphic below to learn more about how VA loans work in Michigan.