Kentucky VA Loans

Homeownership in Kentucky is a dream for many people, but not everyone has access to a loan program as great as the VA home loan. So whether you are looking to settle down surrounded by beautiful ranches or pristine lakes, you’ll be thrilled with your new home.

With the average listing price of a home in Kentucky landing at $308,449, the VA loan’s signature $0-money-down benefit is a considerable advantage for Kentucky homebuyers.

See also: VA Loan Options for Other States

How to get a VA Loan in Kentucky

VA loans are made by private lenders and guaranteed by the Department of Veterans Affairs. Because private lenders make the loans and not the VA, you need to find a lender licensed in the state you plan to purchase or refinance.

For example, if you're purchasing a home in Lexington, KY, you'll need to find a lender licensed in Kentucky to do the loan.

Other Considerations for Getting a VA Loan in Kentucky

VA borrowers in Kentucky should also consider the cost and impact of VA loan limits and property taxes when making their home purchase.

Kentucky VA Loan Limits

As of Jan 1, 2020, VA borrowers in Kentucky with their full VA loan entitlement are not restricted by VA loan limits. This means you can borrow as much as a lender is willing to lend without needing a down payment.

However, veterans without their full VA loan entitlement are still bound to Kentucky’s VA loan limits.

As of January 1, 2025, VA loan limits for all counties in Kentucky are $806,500.

Property Taxes in Kentucky

Another consideration for VA buyers in Kentucky is property taxes. For certain VA buyers, there are exemptions.

You may be eligible for a property tax exemption in Kentucky if you meet one of the following conditions:

- If you are totally disabled as determined by a government agency, or age 65 and older you may receive a property tax exemption of up to $39,399 on your primary residence.

If you are required to pay property tax in Kentucky, the American Community Survey by the U.S. Census Bureau estimates you may pay the following in each county:

| County | Property Tax Rate |

|---|---|

| Adair County | 0.74% |

| Allen County | 0.70% |

| Anderson County | 0.95% |

| Ballard County | 0.72% |

| Barren County | 0.75% |

| Bath County | 0.77% |

| Bell County | 0.80% |

| Boone County | 0.95% |

| Bourbon County | 0.84% |

| Boyd County | 0.88% |

| Boyle County | 0.88% |

| Bracken County | 0.84% |

| Breathitt County | 0.94% |

| Breckinridge County | 0.73% |

| Bullitt County | 0.94% |

| Butler County | 0.68% |

| Caldwell County | 0.65% |

| Calloway County | 0.70% |

| Campbell County | 1.17% |

| Carlisle County | 0.67% |

| Carroll County | 0.71% |

| Carter County | 0.51% |

| Casey County | 0.71% |

| Christian County | 0.79% |

| Clark County | 0.91% |

| Clay County | 0.84% |

| Clinton County | 0.63% |

| Crittenden County | 0.66% |

| Cumberland County | 0.64% |

| Daviess County | 0.94% |

| Edmonson County | 0.69% |

| Elliott County | 0.66% |

| Estill County | 0.80% |

| Fayette County | 0.98% |

| Fleming County | 0.76% |

| Floyd County | 0.84% |

| Franklin County | 0.96% |

| Fulton County | 0.78% |

| Gallatin County | 1.07% |

| Garrard County | 0.83% |

| Grant County | 0.81% |

| Graves County | 0.66% |

| Grayson County | 0.61% |

| Green County | 0.77% |

| Greenup County | 0.98% |

| Hancock County | 0.70% |

| Hardin County | 0.77% |

| Harlan County | 0.94% |

| Harrison County | 0.74% |

| Hart County | 0.71% |

| Henderson County | 0.87% |

| Henry County | 0.95% |

| Hickman County | 0.80% |

| Hopkins County | 0.83% |

| Jackson County | 0.76% |

| Jefferson County | 0.93% |

| Jessamine County | 0.95% |

| Johnson County | 0.59% |

| Kenton County | 1.13% |

| Knott County | 0.83% |

| Knox County | 0.68% |

| Larue County | 0.70% |

| Laurel County | 0.64% |

| Lawrence County | 0.80% |

| Lee County | 0.86% |

| Leslie County | 0.71% |

| Letcher County | 0.72% |

| Lewis County | 0.73% |

| Lincoln County | 0.72% |

| Livingston County | 0.61% |

| Logan County | 0.75% |

| Lyon County | 0.66% |

| McCracken County | 0.75% |

| McCreary County | 0.68% |

| McLean County | 0.68% |

| Madison County | 0.81% |

| Magoffin County | 0.57% |

| Marion County | 0.77% |

| Marshall County | 0.78% |

| Martin County | 0.74% |

| Mason County | 0.76% |

| Meade County | 0.80% |

| Menifee County | 0.63% |

| Mercer County | 0.85% |

| Metcalfe County | 0.86% |

| Monroe County | 0.72% |

| Montgomery County | 0.79% |

| Morgan County | 0.73% |

| Muhlenberg County | 0.66% |

| Nelson County | 0.89% |

| Nicholas County | 0.70% |

| Ohio County | 0.64% |

| Oldham County | 0.99% |

| Owen County | 0.84% |

| Owsley County | 0.78% |

| Pendleton County | 1.06% |

| Perry County | 0.70% |

| Pike County | 0.69% |

| Powell County | 0.62% |

| Pulaski County | 0.66% |

| Robertson County | 0.80% |

| Rockcastle County | 0.68% |

| Rowan County | 0.68% |

| Russell County | 0.79% |

| Scott County | 0.72% |

| Shelby County | 0.87% |

| Simpson County | 0.72% |

| Spencer County | 0.79% |

| Taylor County | 0.78% |

| Todd County | 0.59% |

| Trigg County | 0.65% |

| Trimble County | 0.77% |

| Union County | 0.86% |

| Warren County | 0.75% |

| Washington County | 0.76% |

| Wayne County | 0.72% |

| Webster County | 0.76% |

| Whitley County | 0.68% |

| Wolfe County | 0.66% |

| Woodford County | 0.75% |

How VA Loans Work in Kentucky

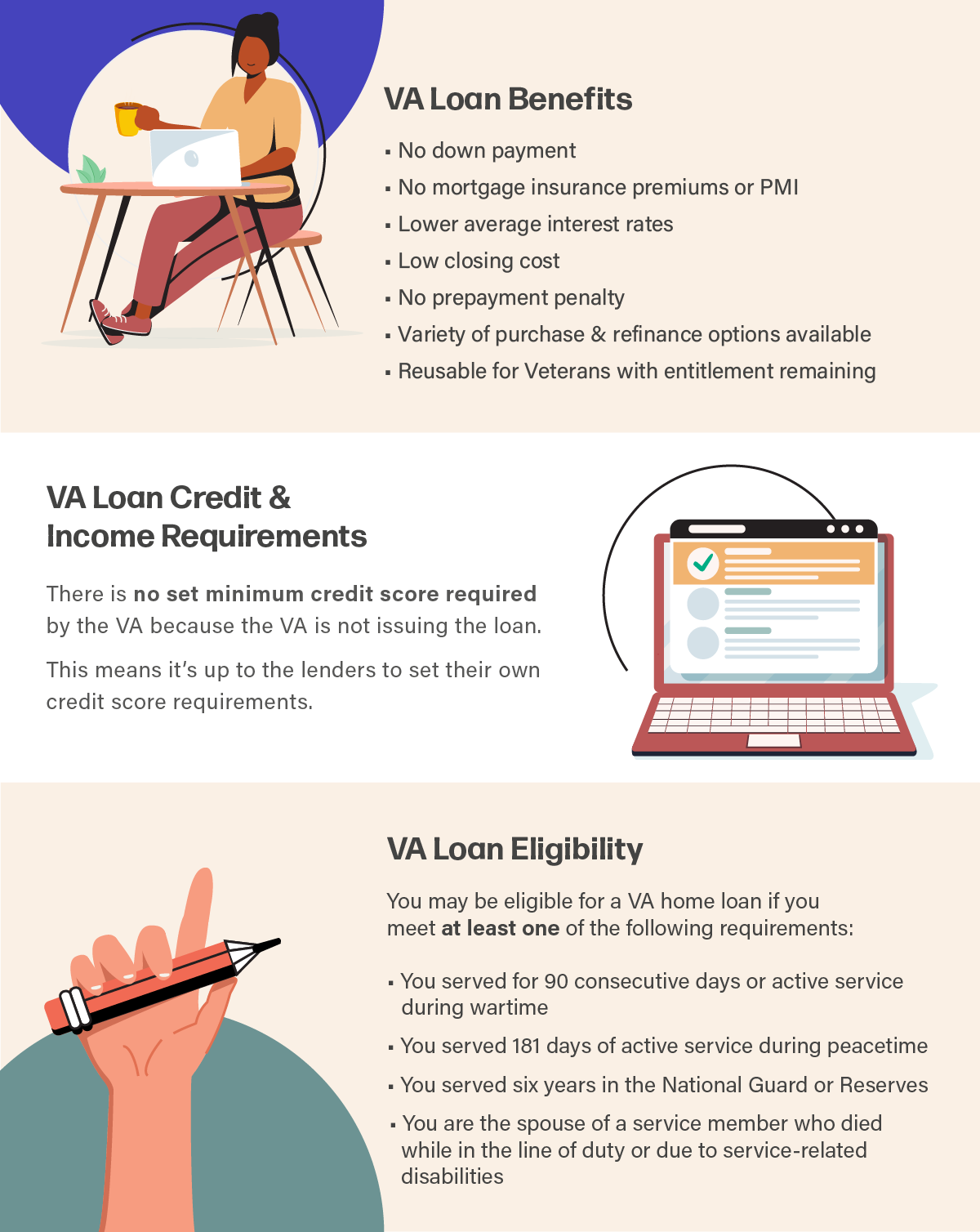

View the graphic below to learn more about how VA loans work in Kentucky.